Unveiling The Pursuit Of Financial Prosperity

Money-making is a universal pursuit, a reflection of our desire for financial security and prosperity. In an ever-evolving world, the ways to make money have expanded and diversified. Whether you're seeking to supplement your income, launch a new business, or achieve financial independence, understanding the art and science of money-making is essential. In this article, we'll explore the significance of money-making, its various avenues, and key principles to enhance your financial well-being.

The Importance Of Money-Making

Financial Security: Money-making is the foundation of financial security. It allows you to meet your basic needs, cover expenses, and create a safety net for the future.

Wealth Accumulation: Beyond meeting your immediate needs, money-making can lead to wealth accumulation and financial freedom. Accumulated wealth can be invested or used to create new income streams.

Pursuit Of Goals: Whether it's homeownership, education, travel, or pursuing a passion, money-making facilitates the pursuit of your goals and dreams.

Entrepreneurship: Money-making often involves entrepreneurial endeavors, which can drive innovation and economic growth.

Avenues For Money-Making

Employment: Traditional employment remains a fundamental way to make money. It provides job security, benefits, and a steady paycheck.

Side Hustles: Side jobs, freelancing, or gig work offer opportunities to supplement your income. They are flexible and can accommodate various skill sets and schedules.

Entrepreneurship: Starting your own business is a significant money-making avenue. It requires effort, risk, and dedication but offers the potential for substantial profits.

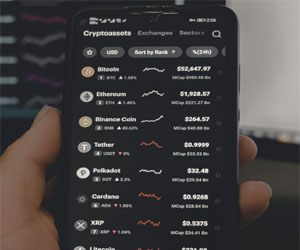

Investments: Investing in stocks, real estate, bonds, or mutual funds can generate income and capital appreciation over time.

Online Ventures: Creating and monetizing online content, such as websites, blogs, YouTube channels, or online courses, can provide income through advertising, sponsorships, affiliate marketing, or product sales.

Rental Income: Owning and renting out properties can create a steady rental income stream.

Principles For Effective Money-Making

Passion And Interest: Pursue money-making opportunities aligned with your passions and interests. When you're passionate about your work, you're more likely to excel and find fulfillment.

Education And Skill Development: Invest in your education and skill development. Continuous learning opens doors to new opportunities and income potential.

Financial Planning: Create a financial plan that outlines your income goals, expenses, and savings targets. Effective financial planning helps you manage your money efficiently.

Risk Management: Understand and manage risks associated with various money-making ventures. Diversification and risk assessment are critical.

Persistence And Adaptability: Money-making often involves facing challenges. Be persistent, and adapt to changing circumstances and market conditions.

Ethical Practices: Conduct your money-making endeavors with integrity and ethical practices. Building a positive reputation can lead to long-term success.

Money-making is a fundamental aspect of modern life, shaping our financial well-being and opportunities for growth. Understanding the various avenues for generating income and following key principles can lead to financial security, wealth accumulation, and the pursuit of your goals and dreams. Whether you're exploring side hustles, entrepreneurship, investments, or online ventures, the journey of money-making is filled with potential for personal and financial growth.

Building And Maintaining An Emergency Fund

What Is An Emergency Fund?

What Is An Emergency Fund?

An emergency fund is a dedicated savings account or pool of money set aside for unexpected expenses or emergencies. These unforeseen events can include medical bills, car repairs, home maintenance, job loss, or any other financial crisis that may disrupt your regular budget. The primary purpose of an emergency fund is to provide a financial buffer that allows you to navigate such situations without resorting to high-interest loans or credit cards.

Why Is An Emergency Fund Important?

Financial Security: Having an emergency fund provides a sense of financial security. It ensures that you can address sudden expenses without jeopardizing your long-term financial stability.

Achieving Financial Freedom And Peace Of Mind

The Essence Of Cost-Effective Living

The Essence Of Cost-Effective Living

At its core, cost-effective living revolves around making smart financial choices without compromising on quality. It's about assessing your expenses, finding areas where you can save, and prioritizing what's truly valuable to you. It's not about denying yourself life's pleasures; it's about enjoying them in a way that aligns with your financial goals.

The Benefits Of Cost-Effective Living

1. Financial Freedom

One of the primary benefits of cost-effective living is the road to financial freedom. By cutting unnecessary expenses, managing your budget wisely, and saving consistently, you can build a strong financial foundation. This financial security provides you with more choices in life, such as the ability to pursue your dreams, travel, or retire early.

2. Reduced Stress

Financial stress is a significant source of anxiety for many people. Constantly worrying about bills and debt can take a toll on your mental and physical health. Cost-effective living helps alleviate this stress by providing you with a clear financial plan and reducing the burden of financial obligations.

3. Improved Quality Of Life

Contrary to the misconception that frugality diminishes the quality of life, cost-effective living often enhances it. By focusing on what truly matters to you and cutting out unnecessary expenses, you can afford to invest in experiences and items that bring you genuine joy and satisfaction.

Securing Your Golden Years

Reduced Dependency: Relying solely on government programs or family support for retirement is risky. Planning allows for financial independence in your later years.

Reduced Dependency: Relying solely on government programs or family support for retirement is risky. Planning allows for financial independence in your later years.

Peace Of Mind: Knowing that you have a well-thought-out retirement plan in place reduces stress and anxiety about your financial future.

Key Steps In Retirement Planning:

Set Clear Goals: Start by defining your retirement goals. What kind of lifestyle do you want in retirement? Consider your housing, travel, and healthcare needs, as well as any hobbies or interests you'd like to pursue.

Assess Your Current Financial Situation: Calculate your current savings, investments, and assets. This is your starting point for building your retirement nest egg.

Determine Your Retirement Income: Estimate your future sources of income, such as pensions, Social Security, and any rental or investment income. Understanding where your money will come from is critical.

Create A Budget: Develop a retirement budget to outline your expected expenses in retirement. This will help you see whether your income sources will cover your costs.

Savings And Investments: Start saving and investing for retirement as early as possible. Contribute regularly to retirement accounts like 401(k)s or IRAs, and consider diversifying your investments to manage risk.

Securing Your Financial Future

Financial Security: By understanding how to manage money effectively, individuals can build financial security and safeguard themselves against unexpected setbacks, such as medical emergencies or job loss.

Financial Security: By understanding how to manage money effectively, individuals can build financial security and safeguard themselves against unexpected setbacks, such as medical emergencies or job loss.

Wealth Building: Financial education is the key to wealth creation. Learning how to invest wisely and grow your money is vital for long-term financial success.

Reduced Debt Burden: Financial literacy can help people manage and reduce debt efficiently, preventing the burden of high-interest loans.

Retirement Planning: Planning for retirement is a complex process, and financial education is critical to ensure that individuals can retire comfortably.

Access To Financial Education:

Financial education can be accessed in various ways:

Formal Education: Many schools and universities offer courses in personal finance, giving students a foundation in financial literacy.

Online Resources: The internet is a treasure trove of financial education resources, from websites and blogs to online courses and YouTube channels.

Workplace Programs: Some employers offer financial wellness programs to help employees manage their finances more effectively.

The Path To Financial Prosperity

3. Risk Tolerance: Understanding your risk tolerance is crucial. A risk assessment helps you determine how much market volatility you can endure. Your investment choices should align with your risk tolerance to ensure you stay committed to your long-term strategy.

3. Risk Tolerance: Understanding your risk tolerance is crucial. A risk assessment helps you determine how much market volatility you can endure. Your investment choices should align with your risk tolerance to ensure you stay committed to your long-term strategy.

4. Asset Allocation: Asset allocation is the art of dividing your investments across different asset classes, such as stocks, bonds, and real estate. Proper asset allocation can enhance returns and reduce risk based on your risk tolerance and financial goals.

5. Long-Term Focus: Investment success is often a result of a long-term perspective. The ability to weather short-term market fluctuations and stay committed to your investment strategy is key. By focusing on your long-term goals, you can avoid impulsive decisions driven by short-term volatility.

6. Quality Research: Informed decisions are the bedrock of investment success. Conduct thorough research, analyze investment options, and consider various factors, including financial health, management quality, and industry trends, before making investment choices.

7. Regular Review And Rebalancing: Investment portfolios should be regularly reviewed, and necessary adjustments made to maintain your target asset allocation. Rebalancing ensures that your portfolio stays aligned with your investment goals.

The Power Of Financial Tools

Goal Achievement: These tools aid in achieving financial goals by providing a structured approach to saving, investing, and budgeting.

Goal Achievement: These tools aid in achieving financial goals by providing a structured approach to saving, investing, and budgeting.

Efficiency: Financial tools streamline various financial tasks, saving time and reducing the risk of human error in calculations and planning.

Common Types Of Financial Tools:

Budgeting Apps: Budgeting apps like Mint, YNAB (You Need A Budget), and Personal Capital help users create budgets, track expenses, and set savings goals.

Investment Platforms: Brokerage platforms such as E*TRADE, Fidelity, and Robinhood offer tools for trading stocks, bonds, mutual funds, and more.

Financial Planning Software: Tools like Quicken and Microsoft Money enable users to manage their finances, track investments, and plan for retirement.