Securing Your Financial Future

Financial education is a valuable and often underestimated tool that empowers individuals to take control of their financial lives, make informed decisions, and secure a stable financial future. In a world where personal finance is increasingly complex, understanding the principles of financial management is crucial for achieving financial well-being. This article explores the significance of financial education and why it should be a priority for everyone.

Why Financial Education Matters:

Financial education is essential for several reasons:

Informed Decision-Making: Financial education equips individuals with the knowledge and skills to make informed decisions about their money. This includes budgeting, saving, investing, managing debt, and understanding financial products.

Financial Security: By understanding how to manage money effectively, individuals can build financial security and safeguard themselves against unexpected setbacks, such as medical emergencies or job loss.

Wealth Building: Financial education is the key to wealth creation. Learning how to invest wisely and grow your money is vital for long-term financial success.

Reduced Debt Burden: Financial literacy can help people manage and reduce debt efficiently, preventing the burden of high-interest loans.

Retirement Planning: Planning for retirement is a complex process, and financial education is critical to ensure that individuals can retire comfortably.

Access To Financial Education:

Financial education can be accessed in various ways:

Formal Education: Many schools and universities offer courses in personal finance, giving students a foundation in financial literacy.

Online Resources: The internet is a treasure trove of financial education resources, from websites and blogs to online courses and YouTube channels.

Workplace Programs: Some employers offer financial wellness programs to help employees manage their finances more effectively.

Seminars And Workshops: Attend financial seminars and workshops in your community, often organized by financial institutions or nonprofit organizations.

Key Financial Education Topics:

Financial education covers a wide range of topics, including:

Budgeting: Learning how to create and stick to a budget is the cornerstone of financial stability.

Saving And Investing: Understanding the importance of saving and how to invest for the future is critical for building wealth.

Debt Management: Learning to manage and reduce debt efficiently is essential for avoiding financial stress.

Retirement Planning: Knowing how to plan for retirement, including saving and investment strategies, is crucial for a comfortable post-work life.

Insurance: Understanding different types of insurance, such as health, life, and disability insurance, is essential for protecting against unexpected financial setbacks.

The Benefits Of Financial Education:

Empowerment: Financial education empowers individuals to make informed decisions about their money, leading to greater financial independence.

Reduced Stress: Understanding personal finance reduces the stress and anxiety often associated with financial matters.

Long-Term Security: With the knowledge gained through financial education, individuals can secure their financial future and work towards their financial goals.

Financial education is a powerful tool that enables individuals to take control of their financial lives, make informed decisions, and secure a stable and prosperous future. It's not just a nice-to-have; it's a necessity in today's complex financial world. By investing in your financial education, you invest in your financial well-being. So, whether you're just starting your financial journey or looking to enhance your knowledge, consider making financial education a priority in your life.

Achieving Freedom And Choice

The 4% Rule And Safe Withdrawal Rates

The 4% Rule And Safe Withdrawal Rates

One of the central tenets of FIRE is the 4% rule. It's a guideline that suggests you can safely withdraw 4% of your portfolio's value annually, adjusted for inflation, without depleting your savings. This rule underlines the importance of achieving a specific savings target to sustain your desired lifestyle in retirement.

Strategies For Achieving FIRE

The path to FIRE is not one-size-fits-all, but there are common strategies that many adopt:

High Savings Rate: FIRE enthusiasts often save a significant portion of their income, typically 50% or more. This aggressive saving is a cornerstone of the movement.

Frugality: Living well below your means is another key element. This means cutting unnecessary expenses and embracing a frugal lifestyle.

Investing: FIRE adherents prioritize investing their savings, aiming for high returns. A diversified portfolio is essential for managing risk.

Charting Your Own Path To Independence And Success

Flexibility: You have the flexibility to set your own work hours and work from any location, giving you a better work-life balance.

Flexibility: You have the flexibility to set your own work hours and work from any location, giving you a better work-life balance.

Benefits Of Self-Employment

Personal Fulfillment: Pursuing your own business allows you to follow your passions, creating a sense of personal fulfillment that can be difficult to achieve in a traditional job.

Unlimited Earning Potential: The sky's the limit when it comes to income potential. The more you put into your business, the more you can get out of it.

Tax Benefits: Self-employed individuals often have access to tax benefits and deductions that can reduce their tax liability.

Creative Control: You have complete creative control over your business, allowing you to shape your brand and offerings according to your vision.

Challenges Of Self-Employment

Financial Uncertainty: Self-employment often comes with income variability. You may experience feast-and-famine cycles, requiring careful financial planning.

No Employer Benefits: You won't have access to employer benefits like health insurance, retirement plans, or paid time off. You must provide these for yourself.

Responsibilities: As a self-employed individual, you're responsible for all aspects of your business, from marketing to bookkeeping, which can be overwhelming.

Building A Prosperous Future

A strong foundation of financial literacy is crucial for effective wealth generation. To make informed decisions about saving, investing, and managing money, one must understand basic financial concepts like budgeting, investing, and debt management. Many resources, from books and courses to online financial tools, can help individuals build their financial knowledge.

A strong foundation of financial literacy is crucial for effective wealth generation. To make informed decisions about saving, investing, and managing money, one must understand basic financial concepts like budgeting, investing, and debt management. Many resources, from books and courses to online financial tools, can help individuals build their financial knowledge.

2. Saving And Budgeting: The Starting Point

Saving and budgeting are the first steps in wealth generation. Creating a budget that tracks income and expenses allows you to identify areas where you can cut costs and allocate more money toward savings and investments. Developing a habit of consistently saving a portion of your income is essential for building wealth.

3. Debt Management: Reduce Financial Leaks

High-interest debt, such as credit card debt, can significantly hinder wealth generation. Prioritize paying off outstanding debts and use strategies to reduce interest expenses. Managing and eliminating debt allows you to redirect funds toward investments and wealth-building opportunities.

4. Investment: Growing Wealth Over Time

Investing is a fundamental wealth generation strategy. When you invest your money in assets like stocks, real estate, or bonds, it has the potential to grow over time. Compound interest and the power of long-term investments are the keys to significant wealth accumulation.

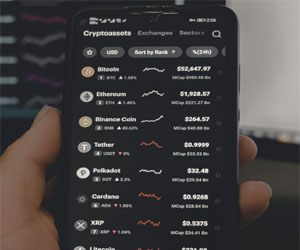

Exploring Income Streams

The Significance Of Income Streams

The Significance Of Income Streams

Diversifying your income streams is a strategic move that can offer financial stability, security, and a hedge against economic uncertainties. By not relying solely on a single source of income, you can better weather financial challenges and maintain a higher quality of life. Let's take a closer look at the different types of income streams you can cultivate:

Primary Income: Your primary job or business is typically the main source of income for most people. It represents the earnings from your full-time employment or core business activities.

Side Hustles: Side gigs or part-time jobs can add an extra layer of financial security. These income streams can include freelance work, consulting, or any other part-time employment.

Passive Income: Passive income is money earned with minimal ongoing effort. It can come from various sources such as investments, rental properties, royalties, and dividends.

Key To Success In The Digital Age

Building A Strong Online Presence

Create A Professional Website: Your website serves as your digital headquarters. It should be well-designed, user-friendly, and contain essential information about you, your services, or your business. Regularly update your website to reflect your latest achievements and projects.

Utilize Social Media: Active engagement on platforms like LinkedIn, X, Instagram, and Facebook is essential. Consistently share valuable content, participate in discussions, and connect with professionals in your industry.

Content Creation: Create and share content relevant to your expertise. This can include blog posts, videos, podcasts, or whitepapers. High-quality content establishes you as an authority in your field and attracts an audience.

Professional Profiles: Keep your professional profiles up-to-date. This includes your LinkedIn profile, which is essentially your online resume. Use a professional photo, craft a compelling summary, and list your experience and skills.

Online Communities: Join relevant online communities or forums where professionals in your field gather. Participate in discussions, answer questions, and share your expertise to gain recognition.

Guest Blogging And Contributing: Guest blogging and contributing articles to reputable websites in your niche can significantly increase your visibility. These platforms have established audiences that can discover your content.

Online Portfolio: If you are in a creative field, maintain an online portfolio showcasing your work. Include detailed descriptions of your projects and the impact they've had.

A Path To Independence And Security

Financial freedom is a goal that many individuals aspire to achieve. It represents a state where one has the ability to make choices and live life on their terms, without the constraints of financial worries. In this article, we'll explore what financial freedom means, why it's important, and steps to work towards it.

Financial freedom is a goal that many individuals aspire to achieve. It represents a state where one has the ability to make choices and live life on their terms, without the constraints of financial worries. In this article, we'll explore what financial freedom means, why it's important, and steps to work towards it.

Understanding Financial Freedom

Financial freedom is a state of financial well-being in which an individual or household has sufficient wealth and resources to cover all of their basic needs and lifestyle choices. It means having control over your finances, being debt-free, and having the ability to pursue your dreams and passions without financial constraints.

The Importance Of Financial Freedom

Peace Of Mind: Achieving financial freedom provides a deep sense of security and peace. You no longer need to worry about meeting basic needs or unexpected financial crises.

Independence: Financial freedom means you are not reliant on a paycheck or someone else for your financial well-being. You have the independence to make decisions based on your preferences, not financial obligations.

Pursuing Passions: When you are financially free, you have the freedom to pursue your passions, whether it's starting a business, traveling, or engaging in creative endeavors.

Retirement Comfort: Financial freedom enables you to retire comfortably without depending solely on government benefits or a pension.

Steps To Achieve Financial Freedom

Budgeting And Saving: Create a budget to understand your income and expenses. Save consistently, ideally at least 20% of your income, to build an emergency fund and invest for the future.

Building Financial Stability And Freedom

2. Real Estate Investment: Owning and renting out properties is a traditional method of generating passive income. Whether it's residential real estate or commercial properties, rental income can provide a consistent flow of cash, and the properties themselves can appreciate in value over time.

2. Real Estate Investment: Owning and renting out properties is a traditional method of generating passive income. Whether it's residential real estate or commercial properties, rental income can provide a consistent flow of cash, and the properties themselves can appreciate in value over time.

3. Peer-To-Peer Lending: Peer-to-peer lending platforms, such as LendingClub or Prosper, allow you to lend money to individuals or small businesses in exchange for interest payments. This approach lets you act as a lender, and you earn interest as borrowers repay their loans.

4. Create A Blog Or Website: Starting a blog or website focused on a niche you're passionate about can be an effective way to earn passive income. You can monetize your site through advertising, sponsored content, affiliate marketing, and selling digital products.

5. Write An eBook: If you have expertise in a specific field or a talent for storytelling, consider writing an eBook. You can self-publish it on platforms like Amazon Kindle and receive royalties for every sale.

6. Create An Online Course: With the growing demand for online learning, creating and selling online courses is a lucrative option. Platforms like Udemy and Teachable make it easy to reach a global audience.