A Stress-Free Approach To Wealth Building

Investing has long been a cornerstone of financial success, and while many people actively trade stocks, bonds, and other assets, the concept of passive investments is gaining momentum as an alternative approach. Passive investing offers a low-stress, low-maintenance strategy that can yield steady, long-term growth. In this article, we'll delve into the world of passive investments, how they work, and the benefits they offer to investors.

What Are Passive Investments?

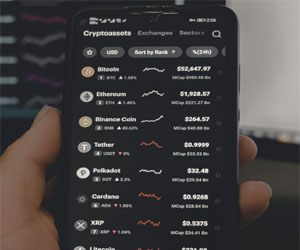

Passive investments, also known as passive funds or index funds, are investment vehicles that aim to replicate the performance of a specific market index or asset class, rather than attempting to beat the market through active management. Passive investors typically purchase exchange-traded funds (ETFs) or index mutual funds that mirror the holdings and performance of a given index, such as the S&P 500 for U.S. stocks or the FTSE All-World for global equities.

How Do Passive Investments Work?

Passive investments work on the premise that attempting to outperform the market through active trading or stock picking is often a futile endeavor. Instead, passive investors opt for a more straightforward approach:

Diversification: Passive funds offer a diversified portfolio of assets, reducing the risk associated with individual stock or bond selection.

Low Costs: Passive investments generally have lower management fees compared to actively managed funds because they require less hands-on management.

Tracking An Index: These funds aim to replicate the performance of a specific index by holding the same assets in similar proportions. For example, an S&P 500 index fund will hold the 500 stocks in the S&P 500 index.

Long-Term Holding: Passive investors typically buy and hold these investments for the long term, resisting the urge to make frequent trades in response to market fluctuations.

Benefits Of Passive Investments:

Lower Costs: Passive investments are known for their cost-efficiency. With lower management fees and reduced trading activity, they tend to have lower expense ratios compared to actively managed funds.

Diversification: Passive investments offer a broad range of assets, reducing individual stock or bond risk. Diversification helps protect your portfolio against the potential underperformance of a single asset.

Consistency: Passive investments are designed to replicate the performance of an index, which can lead to a consistent and predictable investment strategy over time.

Reduced Stress: Because passive investing is a "set it and forget it" strategy, it requires less day-to-day attention and monitoring. This can reduce the stress associated with managing investments.

Historically Competitive Returns: Over the long term, passive investments have historically performed well, often outperforming actively managed funds due to their lower costs.

Challenges Of Passive Investing:

While passive investments offer numerous advantages, they may not be the right choice for all investors. Some challenges to consider include:

Limited Customization: Passive funds follow a specific index, limiting the ability to customize a portfolio to meet specific financial goals or ethical criteria.

Market Volatility: Passive investments are subject to market fluctuations, and investors should be prepared for periods of volatility.

Benchmark Underperformance: There is no guarantee that a passive investment will outperform its benchmark, although this is generally the goal.

Passive investments offer a sensible and low-stress approach to wealth building. They provide a diversified, cost-effective, and historically competitive option for investors who are looking for a straightforward strategy to achieve their long-term financial goals. Passive investments are a valuable addition to any well-diversified investment portfolio, allowing investors to benefit from the long-term growth potential of the market with reduced stress and minimal management.

Diversifying Your Financial Portfolio

Flexibility: Income generation offers flexibility in terms of work arrangements. It can involve part-time work, freelancing, online businesses, or investments, allowing you to choose opportunities that align with your lifestyle and goals.

Flexibility: Income generation offers flexibility in terms of work arrangements. It can involve part-time work, freelancing, online businesses, or investments, allowing you to choose opportunities that align with your lifestyle and goals.

Forms Of Income Generation

Employment: Your primary job or career is often the most significant source of income. Employment provides stability and the foundation for other income streams.

Side Hustles: Side jobs or part-time work, such as freelancing, consulting, or gig economy work, can provide additional income while accommodating your primary job.

Investments: Investing in stocks, real estate, bonds, or mutual funds can generate passive income through dividends, interest, or capital gains.

Business Ownership: Starting your own business or investing in a franchise can create a substantial income stream. Successful entrepreneurship often requires significant time and effort but can be highly rewarding.

Rental Income: Owning property and renting it out, whether residential or commercial, can generate consistent rental income.

The Fuel For A Fulfilling Life

Connection With Others: Pursuing your passions can lead to connections with like-minded individuals who share your interests. This can foster a sense of community and support.

Connection With Others: Pursuing your passions can lead to connections with like-minded individuals who share your interests. This can foster a sense of community and support.

Uncovering Your Personal Passions

Reflect On Your Interests: Take time to think about the activities or subjects that excite you the most. What are the things you look forward to doing?

Try New Things: Be open to trying new activities or exploring new interests. Sometimes, you may discover a passion you never knew existed.

Listen To Your Heart: Pay attention to your inner feelings and emotions. Often, your heart will guide you towards your true passions.

Prioritize Self-Care: Give yourself the time and space to engage in activities you love. Self-care is essential for nurturing your passions.

The Rise Of Part-Time Entrepreneurship

Skill Development: Part-time entrepreneurs can leverage their existing skills and expertise from their full-time jobs, potentially saving time and resources in their business endeavors. They can also learn new skills that can be applied to both their current jobs and their entrepreneurial ventures.

Skill Development: Part-time entrepreneurs can leverage their existing skills and expertise from their full-time jobs, potentially saving time and resources in their business endeavors. They can also learn new skills that can be applied to both their current jobs and their entrepreneurial ventures.

Diverse Income Streams: Having multiple income streams from both a job and a side business can lead to increased financial stability and the potential for greater overall earnings.

Work-Life Balance: Part-time entrepreneurship allows individuals to better manage their work-life balance. They can allocate their time and energy to fit their schedules, reducing the stress associated with juggling a full-time job and a business.

Keys To Successful Part-Time Entrepreneurship

Time Management: Effective time management is crucial. Entrepreneurs must create detailed schedules, allocate specific time blocks for their businesses, and remain disciplined about adhering to these schedules.

Clear Goals: Part-time entrepreneurs should establish clear and realistic business goals. Knowing the desired outcomes and milestones will guide their efforts and keep them motivated.

Outsourcing And Delegation: Learning to delegate tasks and outsource activities when necessary can free up valuable time and reduce the burden of managing all aspects of the business alone.

Market Research: Conduct thorough market research to understand the target audience, competition, and trends within the chosen industry. This knowledge can inform business decisions and strategies.

Embracing A Multifaceted Approach To Personal Growth

Travel And Cultural Exposure: Traveling to new places, engaging with diverse cultures, and experiencing different environments is an excellent way to broaden one's horizons and learn about the world.

Travel And Cultural Exposure: Traveling to new places, engaging with diverse cultures, and experiencing different environments is an excellent way to broaden one's horizons and learn about the world.

Community Engagement: Volunteering, joining community organizations, or participating in civic activities provides opportunities to give back to society, make a positive impact, and meet like-minded individuals.

Hobbies And Passions: Pursuing diverse opportunities in hobbies and interests, whether it's playing a musical instrument, practicing a sport, or creating art, can lead to personal satisfaction and skill development.

Benefits Of Embracing Diverse Opportunities

Personal Growth: Diverse opportunities challenge individuals to step out of their comfort zones, fostering personal growth, resilience, and adaptability.

Challenges And Solutions

2. Lack Of Employment Benefits

2. Lack Of Employment Benefits

Gig workers typically do not enjoy the same benefits as traditional employees, such as health insurance, retirement plans, and paid time off. This lack of benefits can leave gig workers vulnerable in times of illness or retirement.

Solution: Some gig platforms are starting to offer benefits to their workers, and policymakers are discussing ways to extend certain benefits to gig workers through legislative measures. Gig workers can also explore private options for health insurance and retirement savings.

3. Job Security

Gig workers often lack job security, as their employment is contingent on demand and competition. They can be subject to abrupt changes in work volume, which may lead to income fluctuations.

Solution: To enhance job security, gig workers can consider multiple gig platforms and projects, thus reducing their reliance on a single income source. Policymakers could explore ways to provide more stability, such as imposing regulations that protect gig workers from abrupt deactivations and guaranteeing a certain level of compensation.

4. Legal And Regulatory Issues

The gig economy operates in a legal gray area, with questions about worker classification, labor rights, and taxation. This ambiguity can lead to disputes between workers, platforms, and regulators.

Solution: Policymakers should work towards clarifying the legal status of gig workers and create fair regulations that balance the flexibility of the gig economy with worker rights. Additionally, gig workers can educate themselves about the legal aspects of their work and stay informed about any changes in regulations.

Unveiling The Pursuit Of Financial Prosperity

Entrepreneurship: Money-making often involves entrepreneurial endeavors, which can drive innovation and economic growth.

Entrepreneurship: Money-making often involves entrepreneurial endeavors, which can drive innovation and economic growth.

Avenues For Money-Making

Employment: Traditional employment remains a fundamental way to make money. It provides job security, benefits, and a steady paycheck.

Side Hustles: Side jobs, freelancing, or gig work offer opportunities to supplement your income. They are flexible and can accommodate various skill sets and schedules.

Entrepreneurship: Starting your own business is a significant money-making avenue. It requires effort, risk, and dedication but offers the potential for substantial profits.

Investments: Investing in stocks, real estate, bonds, or mutual funds can generate income and capital appreciation over time.

Online Ventures: Creating and monetizing online content, such as websites, blogs, YouTube channels, or online courses, can provide income through advertising, sponsorships, affiliate marketing, or product sales.

Rental Income: Owning and renting out properties can create a steady rental income stream.

Principles For Effective Money-Making

Passion And Interest: Pursue money-making opportunities aligned with your passions and interests. When you're passionate about your work, you're more likely to excel and find fulfillment.

Education And Skill Development: Invest in your education and skill development. Continuous learning opens doors to new opportunities and income potential.