The Key To Financial Success

Financial decision-making is at the heart of personal finance, influencing every aspect of our financial well-being. From day-to-day spending choices to long-term investment strategies, the decisions we make play a pivotal role in determining our financial security and the achievement of our financial goals. In this article, we delve into the significance of financial decision-making and how to master this crucial skill.

Understanding Financial Decision-Making: Financial decision-making involves the process of choosing how to manage, allocate, and invest your money. It encompasses a wide range of choices, such as budgeting, investing, saving, managing debt, and planning for major financial goals like buying a home or retiring comfortably.

The Significance Of Financial Decision-Making:

Lifestyle And Goals: Financial decisions shape the lifestyle you can afford and whether you can achieve your financial goals.

Financial Security: Good financial decisions can lead to financial security, ensuring you have a safety net in case of unexpected expenses or emergencies.

Wealth Building: Smart financial decisions can help you accumulate wealth over time, giving you the means to enjoy a comfortable retirement and the freedom to pursue your aspirations.

Key Aspects Of Financial Decision-Making:

Budgeting: Creating and sticking to a budget is a fundamental financial decision. It helps you allocate your income effectively and manage your expenses.

Savings: Deciding how much to save and where to save it is a key decision. It's about balancing your current needs with your future financial security.

Investment Choices: Deciding where and how to invest your money, whether in stocks, bonds, real estate, or other assets, has a significant impact on your financial growth.

Debt Management: How you manage and pay off debts, such as credit card balances and loans, is a crucial financial decision. It can affect your financial health and credit score.

Retirement Planning: Deciding when and how to start saving for retirement is a major financial decision that influences your post-work life.

Benefits Of Effective Financial Decision-Making:

Financial Security: Making informed decisions reduces the risk of falling into financial turmoil and ensures you have the resources to deal with unexpected expenses.

Goal Achievement: Good financial decision-making is the bridge to achieving your financial goals, whether it's buying a house, funding your children's education, or retiring comfortably.

Wealth Building: Smart financial decisions lead to wealth accumulation over time, providing financial freedom and the ability to enjoy life on your terms.

Reduced Financial Stress: Knowing you're making responsible financial decisions provides peace of mind and reduces financial stress and anxiety.

Mastering Financial Decision-Making:

Set Clear Goals: Clearly define your financial goals, both short-term and long-term. Having a target makes it easier to align your decisions with your objectives.

Educate Yourself: Invest time in learning about personal finance and investment. The more you know, the better decisions you can make.

Seek Advice: Consult with financial advisors or experts when needed, especially for complex financial decisions like investing or retirement planning.

Budget And Plan: Create a budget and financial plan to provide a structured framework for your decision-making.

Review Regularly: Continuously review and adjust your financial decisions as your goals and circumstances change.

Mastering financial decision-making is paramount for personal finance success. Whether it's day-to-day choices about spending or more significant decisions about investing and retirement planning, your financial choices shape your financial future. By embracing a thoughtful, informed, and disciplined approach to financial decision-making, you can achieve your goals, secure your financial well-being, and enjoy the peace of mind that comes with responsible financial management.

A Beginner's Guide To Building Wealth

3. Risk And Return: Understanding the risk-return relationship is fundamental. In general, investments with the potential for higher returns come with higher levels of risk. Low-risk investments tend to offer stability but may yield lower returns. Your investment strategy should align with your risk tolerance and financial goals.

3. Risk And Return: Understanding the risk-return relationship is fundamental. In general, investments with the potential for higher returns come with higher levels of risk. Low-risk investments tend to offer stability but may yield lower returns. Your investment strategy should align with your risk tolerance and financial goals.

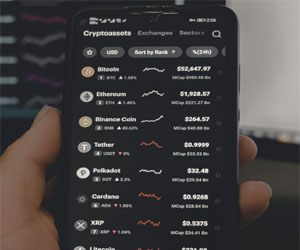

4. Asset Classes: There are several asset classes in which you can invest:

Stocks: These represent ownership in a company and offer the potential for capital appreciation.

Bonds: Bonds are debt securities that pay periodic interest and return the principal at maturity.

Real Estate: Real estate investments involve physical properties, such as residential and commercial properties.

Commodities: These are physical goods like gold, oil, or agricultural products.

Cash And Cash Equivalents: This category includes assets like savings accounts and short-term certificates of deposit (CDs).

A Path To Financial Prosperity

Investing is not merely about allocating your hard-earned money; it's a dynamic journey where informed decisions can yield substantial rewards. The key to successful investing lies in understanding the nuances of the financial markets, staying attuned to economic trends, and leveraging investment insights to make calculated choices.

Investing is not merely about allocating your hard-earned money; it's a dynamic journey where informed decisions can yield substantial rewards. The key to successful investing lies in understanding the nuances of the financial markets, staying attuned to economic trends, and leveraging investment insights to make calculated choices.

1. Knowledge Is Power: At the heart of any successful investment strategy is knowledge. Investing without a solid understanding of the underlying assets or markets is akin to navigating uncharted waters blindfolded. To make informed decisions, individuals should continually educate themselves about various investment instruments, market dynamics, and economic indicators. The more you know, the better equipped you are to anticipate market movements and make prudent investment choices.

2. Diversification Is The Foundation: Diversification remains one of the fundamental investment insights. Spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities, helps mitigate risk. It's a hedge against the volatility of any single asset, as different investments often respond differently to market conditions. Diversification can enhance the overall stability of your investment portfolio.

Building A Strong Foundation For A Bright Future

2. Debt Management: Freedom From Financial Burdens

2. Debt Management: Freedom From Financial Burdens

To attain financial security, it's essential to manage and reduce debt. High-interest loans and credit card balances can erode financial stability. Creating a plan to pay down debt systematically and avoid accumulating new debt is crucial. This liberates your income for more productive purposes.

3. Budgeting: Control Your Finances

Budgeting is a powerful tool for managing expenses and achieving financial goals. It allows you to track your income and expenditures, identify areas where you can cut costs, and allocate funds to savings and investments. A well-structured budget ensures you live within your means.

4. Savings And Investments: Building Wealth For The Future

A substantial part of financial security is building wealth for the long term. Regular savings and investments, such as retirement accounts, real estate, and stock portfolios, can provide financial security in retirement and other life stages. Diversifying your investments helps spread risk and increases the potential for financial growth.

Unpacking The Phenomenon Of Workaholism

Productivity: The hustle mentality can boost productivity, as it encourages individuals to stay focused and utilize their time efficiently.

Productivity: The hustle mentality can boost productivity, as it encourages individuals to stay focused and utilize their time efficiently.

Entrepreneurship: Hustle culture often goes hand-in-hand with entrepreneurship, fostering innovation and the development of new business ventures.

Cons Of Hustle Culture

Burnout: The relentless pace of hustle culture can lead to burnout, which can have detrimental effects on physical and mental health.

Neglect Of Well-Being: Hustle culture often overlooks the importance of personal well-being, including physical fitness, mental health, and work-life balance.

Relationship Strain: Excessive focus on work can strain personal relationships and cause individuals to neglect their social lives.

Unsustainability: The constant hustle approach is often unsustainable in the long run, as it can lead to physical and mental exhaustion.

Lack Of Enjoyment: By solely focusing on work and success, individuals may miss out on life's simple pleasures and the joy of the present moment.

Your Path To Financial Success

Financial goals provide clarity and focus. They help you articulate what you want to achieve with your finances, whether it's buying a home, saving for retirement, paying off debt, or going on a dream vacation. Having a clear goal gives your financial decisions purpose and direction.

Financial goals provide clarity and focus. They help you articulate what you want to achieve with your finances, whether it's buying a home, saving for retirement, paying off debt, or going on a dream vacation. Having a clear goal gives your financial decisions purpose and direction.

2. Motivation

Goals act as motivators. When you set clear financial goals, you have a compelling reason to save and invest. Achieving these milestones can be highly motivating and reinforce good financial habits.

3. Prioritization

Goals help you prioritize your spending and saving. By knowing what's most important to you, you can allocate your resources accordingly. This can prevent you from frittering away money on non-essential items.

4. Measuring Progress

Setting specific, measurable goals allows you to track your progress. You can see how far you've come and adjust your financial plan as needed to stay on course.

How To Set Financial Goals

Setting financial goals is a structured process. Here's a step-by-step guide to help you get started:

Identify Your Objectives: Begin by determining what you want to achieve with your finances. Your goals can range from short-term objectives like building an emergency fund to long-term goals like retirement planning.

Make Your Goals SMART: SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Your goals should be clear, quantifiable, realistic, relevant to your life, and set within a specific timeframe.

Prioritize Your Goals: Rank your financial goals in order of importance. This helps you allocate resources appropriately and prevents you from spreading yourself too thin.

Cultivating Financial Mindfulness

Understanding Conscious Spending

Understanding Conscious Spending

Conscious spending involves approaching your financial decisions with awareness and consideration. It's not about depriving yourself of the things you enjoy but rather making informed choices that align with your values, priorities, and long-term goals. This mindful approach helps individuals break free from impulsive purchases and consumerism's grip, enabling them to regain control over their finances.

The Benefits Of Conscious Spending

Financial Freedom: Conscious spending empowers individuals to take charge of their finances. By prioritizing expenses that truly matter and cutting out unnecessary spending, you can increase your savings, reduce debt, and work towards financial freedom.

Reduced Stress: Financial stress is a common source of anxiety. Mindful spending can alleviate this stress by providing a structured and organized financial plan, making it easier to manage your money and handle unexpected expenses.

Value-Based Living: Conscious spending encourages aligning your spending habits with your values and life goals. It allows you to invest in experiences and items that genuinely matter to you, contributing to a more fulfilling and purpose-driven life.