Your Path To Financial Success

Financial success is not just about making money; it's also about how you manage and allocate your resources. One of the key elements in effective financial management is setting and achieving financial goals. These goals serve as a roadmap for your financial journey, guiding your decisions, and helping you stay on track. In this article, we'll explore the importance of financial goals, how to set them, and strategies to achieve them.

The Significance Of Financial Goals

Financial goals are crucial for several reasons:

1. Clarity And Focus

Financial goals provide clarity and focus. They help you articulate what you want to achieve with your finances, whether it's buying a home, saving for retirement, paying off debt, or going on a dream vacation. Having a clear goal gives your financial decisions purpose and direction.

2. Motivation

Goals act as motivators. When you set clear financial goals, you have a compelling reason to save and invest. Achieving these milestones can be highly motivating and reinforce good financial habits.

3. Prioritization

Goals help you prioritize your spending and saving. By knowing what's most important to you, you can allocate your resources accordingly. This can prevent you from frittering away money on non-essential items.

4. Measuring Progress

Setting specific, measurable goals allows you to track your progress. You can see how far you've come and adjust your financial plan as needed to stay on course.

How To Set Financial Goals

Setting financial goals is a structured process. Here's a step-by-step guide to help you get started:

Identify Your Objectives: Begin by determining what you want to achieve with your finances. Your goals can range from short-term objectives like building an emergency fund to long-term goals like retirement planning.

Make Your Goals SMART: SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Your goals should be clear, quantifiable, realistic, relevant to your life, and set within a specific timeframe.

Prioritize Your Goals: Rank your financial goals in order of importance. This helps you allocate resources appropriately and prevents you from spreading yourself too thin.

Set Benchmarks: Create intermediate milestones that act as checkpoints for your progress. These can help you stay motivated and ensure you're moving in the right direction.

Determine The Costs: Calculate how much you need to achieve each goal. Consider inflation and potential investment returns for long-term goals.

Create A Financial Plan: Develop a comprehensive financial plan that outlines how you will achieve your goals. This plan should include saving, investing, and budgeting strategies.

Strategies For Achieving Financial Goals

Once you've set your financial goals, you need strategies to achieve them. Here are some tips to help you succeed:

Automate Savings: Set up automatic transfers to your savings or investment accounts to ensure consistent progress toward your goals.

Reduce Unnecessary Expenses: Analyze your spending habits and cut out non-essential or impulsive purchases.

Increase Income: Explore opportunities to increase your income, such as taking on a side job, freelancing, or investing in education or skills that can boost your earning potential.

Monitor Progress: Regularly review your financial plan and make necessary adjustments. Celebrate your achievements and stay committed to your goals.

Seek Professional Advice: Consult with a financial advisor to get expert guidance on your investments and financial strategy.

Setting and achieving financial goals is a fundamental aspect of personal finance. These goals provide direction, motivation, and a sense of accomplishment as you progress towards financial success. By following a structured approach to goal setting and implementing effective strategies, you can take control of your financial future and work towards the life you desire.

Strategies For A Debt-Free Future

The Importance Of Debt Management:

The Importance Of Debt Management:

Effective debt management is crucial for several reasons:

Financial Stability: Properly managing debt helps maintain financial stability and security. It prevents the debt from spiraling out of control, which could lead to financial hardship.

Reduced Stress: Being in debt can cause stress and anxiety. Effective debt management can alleviate this emotional burden, allowing individuals to regain peace of mind.

Improved Credit Score: Timely debt management and payments can positively impact your credit score, which can be important for future financial endeavors, such as buying a home or securing a loan.

Savings And Investment: Reducing and eliminating debt frees up money for saving and investing, helping you build wealth and achieve financial goals.

Strategies For Debt Management:

Create A Budget: Start by creating a comprehensive budget that outlines your income, expenses, and debt obligations. A budget helps you understand your financial situation and identify areas where you can cut back on spending.

Prioritize Debts: Determine which debts to prioritize. High-interest debts like credit card balances should typically be addressed first, as they accrue interest quickly.

Unlocking Your Full Potential For A Fulfilling Life

Understanding Life Optimization:

Understanding Life Optimization:

Life optimization is a holistic approach to self-improvement that encompasses various dimensions of life. It focuses on achieving a state of balance, fulfillment, and self-actualization in areas such as:

Personal Growth: This includes self-awareness, self-confidence, resilience, and self-motivation. It's about understanding your strengths and weaknesses and actively working on personal growth.

Career And Professional Development: Life optimization involves setting career goals, improving work-life balance, developing leadership skills, and enhancing overall professional performance.

Health And Wellness: Prioritizing physical and mental health is essential. It includes exercise, nutrition, mindfulness, and stress management.

Achieving Freedom And Choice

The 4% Rule And Safe Withdrawal Rates

The 4% Rule And Safe Withdrawal Rates

One of the central tenets of FIRE is the 4% rule. It's a guideline that suggests you can safely withdraw 4% of your portfolio's value annually, adjusted for inflation, without depleting your savings. This rule underlines the importance of achieving a specific savings target to sustain your desired lifestyle in retirement.

Strategies For Achieving FIRE

The path to FIRE is not one-size-fits-all, but there are common strategies that many adopt:

Navigating The Road To Financial Prosperity

2. Establish Clear Financial Goals: Setting specific financial goals is essential for wealth creation. Whether it's saving for a home, building a retirement nest egg, or funding a business venture, millennials should define their objectives and create a plan to achieve them.

2. Establish Clear Financial Goals: Setting specific financial goals is essential for wealth creation. Whether it's saving for a home, building a retirement nest egg, or funding a business venture, millennials should define their objectives and create a plan to achieve them.

3. Smart Budgeting: Creating and adhering to a budget is the foundation of wealth creation. Millennials should track their income, expenses, and savings goals. This practice helps identify areas where they can reduce spending and allocate more funds towards wealth-building initiatives.

Millennials' Quest For Success

Passion For Continuous Learning: Millennials are committed to ongoing self-improvement and learning. They seek out opportunities to expand their knowledge and skills, both personally and professionally. Whether it's pursuing higher education, attending workshops, or engaging in online courses, this generation is determined to stay ahead of the curve in a fast-changing world.

Passion For Continuous Learning: Millennials are committed to ongoing self-improvement and learning. They seek out opportunities to expand their knowledge and skills, both personally and professionally. Whether it's pursuing higher education, attending workshops, or engaging in online courses, this generation is determined to stay ahead of the curve in a fast-changing world.

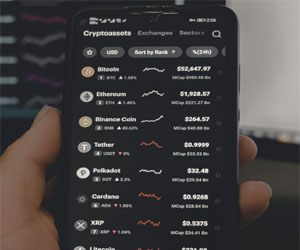

Tech-Savvy And Innovative: Millennials have grown up in the digital age, making them tech-savvy and innovative. They are quick to adapt to new technologies and are often at the forefront of digital trends.

A Stress-Free Approach To Wealth Building

What Are Passive Investments?

What Are Passive Investments?

Passive investments, also known as passive funds or index funds, are investment vehicles that aim to replicate the performance of a specific market index or asset class, rather than attempting to beat the market through active management. Passive investors typically purchase exchange-traded funds (ETFs) or index mutual funds that mirror the holdings and performance of a given index, such as the S&P 500 for U.S. stocks or the FTSE All-World for global equities.

How Do Passive Investments Work?

Passive investments work on the premise that attempting to outperform the market through active trading or stock picking is often a futile endeavor. Instead, passive investors opt for a more straightforward approach:

Diversification: Passive funds offer a diversified portfolio of assets, reducing the risk associated with individual stock or bond selection.

Low Costs: Passive investments generally have lower management fees compared to actively managed funds because they require less hands-on management.

Tracking An Index: These funds aim to replicate the performance of a specific index by holding the same assets in similar proportions. For example, an S&P 500 index fund will hold the 500 stocks in the S&P 500 index.

Cultivating A Prosperous Future

The Benefits Of Financial Mindfulness

The Benefits Of Financial Mindfulness

1. Increased Financial Awareness

One of the primary advantages of financial mindfulness is an enhanced understanding of your financial situation. This awareness helps you gain control over your money, reducing the likelihood of financial surprises.

2. Better Financial Decision-Making

Financial mindfulness encourages you to approach financial decisions with intention and clarity. You are less likely to make impulsive choices and more likely to allocate resources to fulfill your long-term financial goals.

3. Reduced Financial Stress

Financial stress is a common source of anxiety. Financial mindfulness can significantly reduce this stress by providing a structured financial plan and the ability to manage money more effectively.

4. Value-Based Living

Practicing financial mindfulness often leads to value-based living. You prioritize spending on experiences and items that genuinely matter to you, promoting a more fulfilling and purpose-driven life.