Your Gateway To Diversified Investing

Mutual funds have revolutionized the way individuals invest their money, providing an accessible and efficient means of accessing a diversified portfolio of stocks, bonds, and other securities. These investment vehicles have become a cornerstone of modern finance, offering numerous advantages for both seasoned investors and those just starting their investment journey.

Understanding Mutual Funds: A mutual fund is a collective investment scheme where multiple investors pool their money to create a diversified portfolio managed by professional fund managers. Each investor in the fund owns shares, which represent their proportional interest in the fund's holdings.

Key Aspects Of Mutual Funds:

1. Diversification: One of the most significant benefits of mutual funds is diversification. By investing in a mutual fund, you gain exposure to a broad range of securities, spreading risk and reducing the impact of individual stock or bond price fluctuations on your overall portfolio. This diversification is particularly advantageous for risk-averse investors.

2. Professional Management: Mutual funds are managed by experienced professionals who make investment decisions on behalf of fund shareholders. Fund managers conduct in-depth research and analysis to select and manage the fund's holdings, aiming to achieve the fund's specific investment objectives.

3. Accessibility: Mutual funds are accessible to investors with varying levels of experience and financial resources. You can start investing with relatively small amounts of money, making them a convenient choice for those looking to enter the world of investing.

4. Liquidity: Mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the fund's net asset value (NAV). This liquidity provides flexibility for investors who may need to access their funds quickly.

5. Transparency: Mutual funds are required to provide detailed information about their holdings, fees, and performance in prospectuses and periodic reports. This transparency enables investors to make informed decisions about their investments.

6. Variety Of Funds: There are various types of mutual funds to suit different investment objectives and risk tolerances. Common categories include equity funds, bond funds, money market funds, and balanced funds. Additionally, there are sector-specific and international funds, catering to diverse investor preferences.

7. Systematic Investment: Many mutual funds offer systematic investment plans (SIPs), which allow investors to contribute fixed sums of money at regular intervals. This disciplined approach helps individuals build wealth over time and benefit from rupee cost averaging.

8. Regulatory Oversight: Mutual funds are subject to regulatory oversight to protect investor interests. Regulatory bodies enforce compliance with rules and regulations, ensuring that fund managers act in the best interests of investors.

Challenges And Considerations:

While mutual funds offer numerous advantages, it's important to consider the following:

Fees: Mutual funds charge fees, including expense ratios and sales charges, which can impact your overall returns.

Market Risk: Despite diversification, mutual funds are not immune to market fluctuations, and their performance is subject to market conditions.

Past Performance: Past performance is not indicative of future results, and it's essential to focus on a fund's investment strategy and objectives rather than historical returns.

Mutual funds have democratized investing by offering diversification, professional management, and accessibility to a broad range of investors. They serve as a valuable tool for building wealth, achieving financial goals, and navigating the complexities of the financial markets. When choosing a mutual fund, consider your investment objectives, risk tolerance, and the fund's specific strategy to make informed decisions that align with your long-term aspirations. Mutual funds remain a cornerstone of modern finance, connecting individuals with the benefits of a diversified and professionally managed portfolio.

Pathways To Financial Success

Online Ventures: Create and monetize online content, such as blogs, YouTube channels, or e-commerce stores.

Online Ventures: Create and monetize online content, such as blogs, YouTube channels, or e-commerce stores.

Rental Income: If you own property, consider renting it out to generate rental income.

2. Passive Income Investments

Passive income strategies allow you to earn money with minimal ongoing effort. Some popular passive income investments include:

Dividend Stocks: Invest in stocks that pay dividends regularly, providing a steady income stream.

Real Estate Investment Trusts (REITs): Invest in REITs to earn rental income from a diversified real estate portfolio.

Peer-To-Peer Lending: Lend money to individuals or small businesses through peer-to-peer lending platforms in exchange for interest payments.

3. Entrepreneurship And Business Ownership

Starting and owning your own business can be a powerful money-making strategy. This approach requires hard work, dedication, and risk-taking, but it can yield substantial rewards. Some business ownership options include:

Franchise Ownership: Invest in an established franchise to take advantage of a proven business model.

E-commerce Business: Create an online store and sell products or services through platforms like Shopify or Amazon.

Consulting Or Freelancing: Offer your expertise in a particular field as a consultant or freelancer.

The Fuel For A Fulfilling Life

Personal Growth: Exploring your passions can lead to personal growth and self-discovery. You learn more about your strengths, weaknesses, and areas where you can develop.

Personal Growth: Exploring your passions can lead to personal growth and self-discovery. You learn more about your strengths, weaknesses, and areas where you can develop.

Stress Relief: Engaging in activities you're passionate about can be a form of stress relief. It provides an escape from the daily grind and renews your energy.

Connection With Others: Pursuing your passions can lead to connections with like-minded individuals who share your interests. This can foster a sense of community and support.

Uncovering Your Personal Passions

Reflect On Your Interests: Take time to think about the activities or subjects that excite you the most. What are the things you look forward to doing?

Try New Things: Be open to trying new activities or exploring new interests. Sometimes, you may discover a passion you never knew existed.

Listen To Your Heart: Pay attention to your inner feelings and emotions. Often, your heart will guide you towards your true passions.

Prioritize Self-Care: Give yourself the time and space to engage in activities you love. Self-care is essential for nurturing your passions.

Seek Inspiration: Read books, watch documentaries, or follow people who are passionate about similar interests. Their enthusiasm can be contagious.

The Power Of Income Streams

Side Hustles: Part-time jobs, freelancing, or gig work that supplement your primary income.

Side Hustles: Part-time jobs, freelancing, or gig work that supplement your primary income.

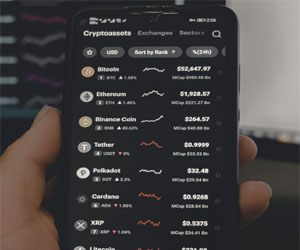

Investments: Earnings from investments in stocks, bonds, real estate, or other assets.

Rental Income: Money earned from renting out properties or assets you own.

Passive Income: Revenue generated from sources that require minimal effort, like royalties from intellectual property or affiliate marketing.

Business Ownership: Profits from owning and operating your own business.

The Benefits Of Income Streams

Financial Security: Diversifying your income sources mitigates the risk associated with relying solely on a single paycheck. If one income stream falters, you still have others to rely on.

Wealth Building: Multiple income streams provide the opportunity to save and invest more, accelerating your wealth-building efforts.

Reduced Stress: Knowing you have various sources of income can significantly reduce financial stress and provide peace of mind.

Non-Traditional Jobs In A Changing Work Landscape

Task-Oriented Roles: Some non-traditional jobs focus on performing specific tasks or providing services on a contract or gig basis.

Task-Oriented Roles: Some non-traditional jobs focus on performing specific tasks or providing services on a contract or gig basis.

Short-Term Contracts: Many non-traditional workers may take on short-term contracts or engagements that can range from days to months.

Why Non-Traditional Jobs Are On The Rise

Several factors have contributed to the increasing popularity of non-traditional jobs:

Technological Advancements: The digital age has enabled remote work, online marketplaces, and freelance platforms, making it easier to connect workers with employers.

Desire For Flexibility: More individuals are seeking a better work-life balance and greater control over their schedules, making non-traditional jobs an attractive option.

Entrepreneurial Spirit: Many non-traditional workers have an entrepreneurial mindset, taking charge of their careers and pursuing multiple income streams.

Economic Uncertainty: The job market's instability has led some individuals to explore non-traditional work as a way to diversify their income sources.

A New Paradigm In The World Of Employment

Short-Term: Task-based work assignments are generally of short duration, often limited to the completion of a specific project or task.

Short-Term: Task-based work assignments are generally of short duration, often limited to the completion of a specific project or task.

Flexibility: Workers engaged in task-based work often have the flexibility to choose when and where they work, as long as they meet project deadlines.

Varied Assignments: Task-based workers may take on a wide variety of assignments in different industries and roles, making it a dynamic and diverse employment model.

Freelance Or Contractual: Task-based workers are often classified as freelancers or independent contractors, meaning they are responsible for their own taxes, benefits, and expenses.

Online Platforms: Many task-based jobs are facilitated through online platforms and marketplaces that connect workers with clients, making it easy for individuals to find and secure assignments.

Advantages Of Task-Based Work

Flexibility: Task-based work offers the flexibility to choose assignments that align with an individual's skills, interests, and availability.

Income Diversification: By taking on various tasks and projects, individuals can diversify their income streams and reduce reliance on a single employer.

Strategies For Financial Success

3. Industry And Location: The industry in which one works and their geographic location can significantly impact earning potential. Certain industries and regions offer higher salaries due to supply and demand dynamics.

3. Industry And Location: The industry in which one works and their geographic location can significantly impact earning potential. Certain industries and regions offer higher salaries due to supply and demand dynamics.

4. Career Progression: Climbing the career ladder, taking on leadership roles, and expanding responsibilities can lead to salary increases and greater earning potential.

5. Negotiation Skills: The ability to negotiate salary and benefits during job offers or performance reviews can have a substantial impact on earning potential.

6. Networking And Relationships: Building a strong professional network and fostering valuable relationships can lead to career opportunities that boost earning potential.

Strategies For Maximizing Earning Potential

Invest In Education And Training: Continuous learning and skill development are key to enhancing earning potential. Consider pursuing additional degrees, certifications, or online courses to stay competitive in your field.

Seek Career Advancement: Actively pursue career advancement opportunities, whether it's within your current organization or by exploring new roles. Take on leadership positions or additional responsibilities to increase your market value.

Unleashing Financial Potential Beyond The 9-to-5

Diverse Avenues For Extra Income

Diverse Avenues For Extra Income

Side Jobs And Freelancing: Taking on side jobs or freelancing work in areas like writing, graphic design, web development, or consulting is a popular way to generate extra income.

Part-Time Employment: Many individuals opt for part-time jobs, which can include roles in retail, food service, tutoring, or other fields that align with their skills and schedules.

Online Ventures: The internet offers a multitude of opportunities for extra income, including e-commerce stores, affiliate marketing, dropshipping, content creation, and online tutoring.

Rental Income: Those with extra space or property may choose to rent it out, generating rental income through platforms like Airbnb or long-term leasing.

Investments: Investing in stocks, bonds, real estate, or peer-to-peer lending can yield extra income in the form of dividends, interest, or rental income.

Selling Assets: Selling unused or unwanted items, such as clothing, electronics, or collectibles, can be a quick way to generate extra income.

Advantages Of Extra Income

Financial Security: Extra income acts as a financial cushion, providing a buffer against unexpected expenses, job loss, or emergencies, enhancing overall financial security.